Components

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

Company FAQ

-

What is PetroFunders?

PetroFunders is an online investment platform that unlocks access to a diverse portfolio of energy investment opportunities previously unavailable to most investors.

-

Where is investor money held?

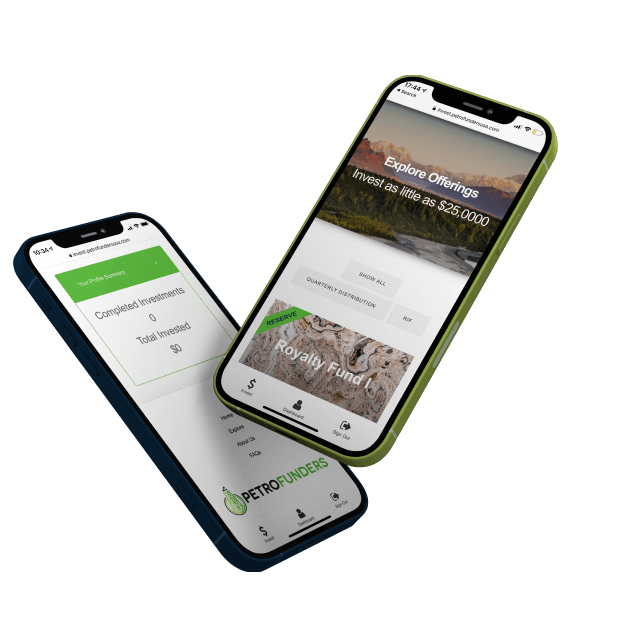

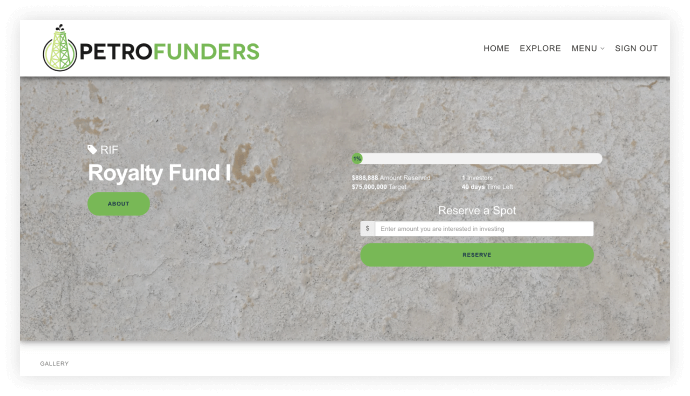

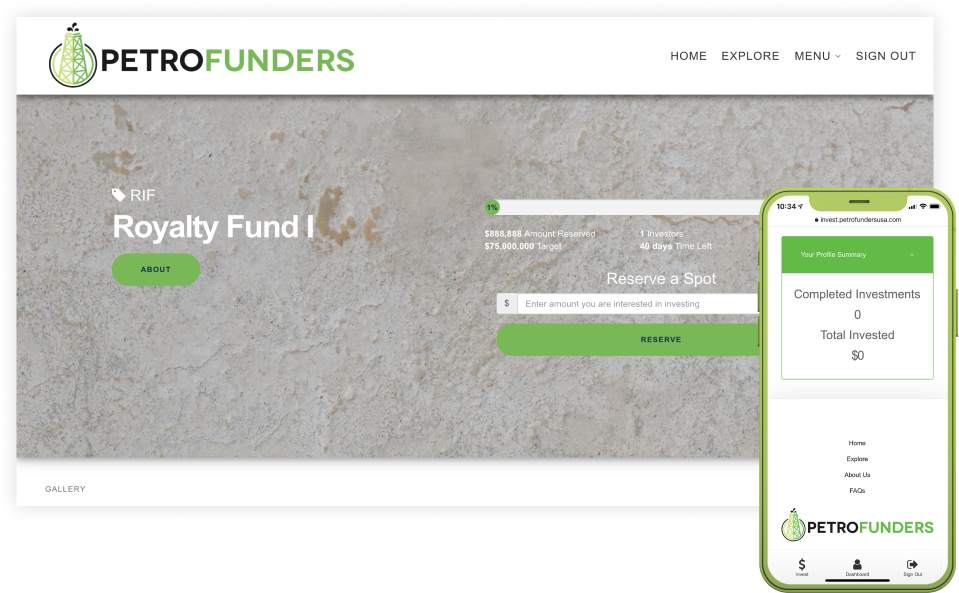

- PetroFunders is an online marketplace for oil and gas investing. We provide access to accredited investors who want to invest in exclusive oil and gas deals. Investors can browse investments, technical data, review due diligence materials, and sign legal documents securely online. Once invested, investors have access to a personal dashboard 24/7.

- Oil and gas operators / originators seeking capital can do so by sending materials to info@petrofunders.com

- We are here to simplify oil and gas investing through technology.

-

Who is PetroFunders?

We are comprised of industry leading talent with regards to industry due diligence and asset management. Our team has extensive industry experience and a track record of delivering value while managing billion-dollar assets. With decades of combined relevant experience, our knowledge gives you the leverage needed to invest with confidence.

-

PetroFunders is an online marketplace for energy investing.

We provide access to accredited investors who want to invest in exclusive energy royalty deals. Investors can browse investments, technical data, review due diligence materials, and sign legal documents securely online. Once invested, investors have access to a personal dashboard 24/7.

-

Invested, investors have access to a personal dashboard 24/7.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

About PetroFunders

Lorem ipsum, or lipsum as it is sometimes known, is dummy text used.

-

How do I contact PetroFunders with investor questions?

-

- To get assistance on making your investment or any general questions, reach out to our investment team at invest@PetroFundersUSA.com.

- We aim to get back with you promptly, which is usually within 3-5 business days.

- For any media inquiries, please reach out to media@PetroFundersUSA.com.

-

-

How does it work?

To get started, create an account on our platform. After select an investment product, invest through a simple checkout process and stay informed through the investor dashboard.

-

What industry experience does the company have?

Our team has the ideal mix of technical, financial, operational and field experience. The team has over 100 years of experience and have performed, over the course of their collective careers, a wide range of jobs in the energy sector. This holistic set of skills allow the team to efficiently and effectively identify and evaluate competitive investment opportunities.

-

What is PetroFunders?

PetroFunders is an online investment platform that unlocks access to a diverse portfolio of energy investment opportunities previously unavailable to most investors.

-

Who is PetroFunders?

We are comprised of industry leading talent with regards to industry due diligence and asset management. Our team has extensive industry experience and a track record of delivering value while managing billion-dollar assets. With decades of combined relevant experience, our knowledge gives you the leverage needed to invest with confidence.

-

Why does industry experience matter?

Each energy source has a unique set of technical and operating characteristics with associated challenges. Likewise, each investment opportunity has a unique set of commercial and land ownership characteristics. In the end, forecasting the production and commercial performance of energy assets relies heavily a combination of detailed analysis and sound judgement based on decades of industry experience. Our deeply experienced team is well placed to deliver for investors.

Not Ready to Get Started Quite Yet?

Tap Into The Knowledge

Company FAQ

Lorem ipsum, or lipsum as it is sometimes known, is dummy text used.

-

Invested, investors have access to a personal dashboard 24/7.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

-

PetroFunders is an online marketplace for energy investing.

We provide access to accredited investors who want to invest in exclusive energy royalty deals. Investors can browse investments, technical data, review due diligence materials, and sign legal documents securely online. Once invested, investors have access to a personal dashboard 24/7.

-

What is PetroFunders?

PetroFunders is an online investment platform that unlocks access to a diverse portfolio of energy investment opportunities previously unavailable to most investors.

-

Where is investor money held?

- PetroFunders is an online marketplace for oil and gas investing. We provide access to accredited investors who want to invest in exclusive oil and gas deals. Investors can browse investments, technical data, review due diligence materials, and sign legal documents securely online. Once invested, investors have access to a personal dashboard 24/7.

- Oil and gas operators / originators seeking capital can do so by sending materials to info@petrofunders.com

- We are here to simplify oil and gas investing through technology.

-

Who is PetroFunders?

We are comprised of industry leading talent with regards to industry due diligence and asset management. Our team has extensive industry experience and a track record of delivering value while managing billion-dollar assets. With decades of combined relevant experience, our knowledge gives you the leverage needed to invest with confidence.

Tap Into The Knowledge & Experience of Industry Titans

A Curated List of Actively Managed Investment Opportunities

A Curated List of Actively

h1 heading

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed quia consequuntur magni dolores eos qui ratione voluptatem sequi nesciunt. Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem. Ut enim ad minima veniam, quis nostrum exercitationem ullam corporis suscipit laboriosam, nisi ut aliquid ex ea commodi consequatur? Quis autem vel eum iure reprehenderit qui in ea voluptate velit esse quam nihil molestiae consequatur, vel illum qui dolorem eum fugiat quo voluptas nulla pariatur?

h2 heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

h3 heading

At vero eos et accusamus et iusto odio dignissimos ducimus qui blanditiis praesentium voluptatum deleniti atque corrupti quos dolores et quas molestias excepturi sint occaecati cupiditate non provident, similique sunt in culpa qui officia deserunt mollitia animi, id est laborum et dolorum fuga. Et harum quidem rerum facilis est et expedita distinctio. Nam libero tempore, cum soluta nobis est eligendi optio cumque nihil impedit quo minus id quod maxime placeat facere possimus, omnis voluptas assumenda est, omnis dolor repellendus. Temporibus autem quibusdam et aut officiis debitis aut rerum necessitatibus saepe eveniet ut et voluptates repudiandae sint et molestiae non recusandae. Itaque earum rerum hic tenetur a sapiente delectus, ut aut reiciendis voluptatibus maiores alias consequatur aut perferendis doloribus asperiores repellat.

h4 heading

h5 heading

h6 heading

Early investors are rewarded with the last of the available incentives.

Available up to $7-10 Million

- Incentive 1

- Incentive 2

- Incentive 3

- Incentive 1

- Incentive 2

- Incentive 3

-

Get Started with as Little as $10,000

-

Commercial Grade Investment Opportunities

-

Tax-Advantaged Cashflow

We Make Investing in Oil & Gas Easy and Accessible

-

Get Started with as Little as $10,000

-

Commercial Grade Investment Opportunities

-

Tax-Advantaged Cashflow

-

Diversified Portfolio of Income Producing Properties

Mission

The Team

Mr. Dukes founded PetroFunders in 2020, bringing to market a fintech-powered investment platform providing access to securities that give investment exposure to the energy sector via the Royalty Interest Fund®. He leverages experience from public and private equity backed oil & gas operating companies where he has managed a collective of $2 billion in assets across the United States. Previously held corporate reservoir engineering positions for Caerus Oil & Gas, a private equity-backed E&P operating company in Colorado. During this time, he was instrumental in maintaining and increasing the enterprise value exceeding $1.4 billion. He has expert technical and A&D experience with oil & gas assets across Texas, Louisiana, North Dakota, Wyoming, Colorado and Utah. He has shown expertise in bringing forth material high value projects that meet or exceed acceptable market hurdle rates. He previously held reservoir engineering roles at QEP Resources, where he launched an industry leading re-entry program in the Louisiana and oversaw $35 million capital expenditure budget, recommended investment decisions on $300+ million drilling program in the Permian Basin and divested of $200+ million in assets across Wyoming and Utah. He holds a B.S. in Petroleum Engineering from the University of Oklahoma and a Series 65 securities license.

Maurice Dukes

Mr. Gornick has over 30 years of oil and gas experience, and has been directing operations, increasing production and proven reserves, and evaluating oil and gas reservoirs in North America since 1990. In addition to being President of East Peak Companies, he is the Chief Reservoir Engineer for Nissan Chemical. His current suite of projects includes new applications for EOR, completions, paraffin treatment, and CO2/helium production. Previously, Mr. Gornick was instrumental in expanding Whiting’s production from around 10,000 barrels per day to over 150,000 barrels per day over a 10 year period. While at QEP Resources, he was responsible for adding 35 million barrels of proved reserves. Steve holds a B.S. in Petroleum Engineering and an MS in Mineral Economics/Operations Research from the Colorado School of Mines.

Stephen Gornick

Mr. Tate is a nationally recognized securities, finance and fintech attorney and counsels’ clients throughout the U.S. and internationally on structured finance, private and public securities offerings, fintech, initial coin offerings and tokens sales, SEC reporting, real estate financings, venture capital and angel financings, fund formation and compliance, business formation and corporate governance. Marty also represents several entrepreneurs, small and large companies as well as private investors, finance companies, national and regional banks, investment banks and venture capital and private equity firms. In working with such clients, he regularly advises on various transactions, financings, contracts and agreements in an array of matters. Throughout his career, he has provided counsel in association with over $500 million in debt and equity financings.

Marty Tate

Mr. Sloan has over 30 years of oil and gas experience. He brings deep knowledge of upstream A&D processes, partnerships and corporate governance. Most recently as President and CEO he oversaw the completion of over a dozen US onshore divestments by Vanguard Natural Resources to mostly private operators and gained relevant insights into PetroFunders’ marketplace. Previously Mr. Sloan held senior leadership roles including SVP of Strategy for Hess and President of BP Russia; numerous corporate and business unit level CFO roles; and A&D oriented roles such as M&A Director for BP. Mr. Sloan has extensive experience in the board room as a director for companies including Vanguard Natural Resources, TNK and Medgaz . He graduated from Colgate University with BA in Economics (Honors) and from the University of Chicago with an MBA.

Scott Sloan

The Team

Mr. Dukes founded PetroFunders in 2020, bringing to market a fintech-powered investment platform providing access to securities that give investment exposure to the energy sector via the Royalty Interest Fund®. He leverages experience from public and private equity backed oil & gas operating companies where he has managed a collective of $2 billion in assets across the United States. Previously held corporate reservoir engineering positions for Caerus Oil & Gas, a private equity-backed E&P operating company in Colorado. During this time, he was instrumental in maintaining and increasing the enterprise value exceeding $1.4 billion. He has expert technical and A&D experience with oil & gas assets across Texas, Louisiana, North Dakota, Wyoming, Colorado and Utah. He has shown expertise in bringing forth material high value projects that meet or exceed acceptable market hurdle rates. He previously held reservoir engineering roles at QEP Resources, where he launched an industry leading re-entry program in the Louisiana and oversaw $35 million capital expenditure budget, recommended investment decisions on $300+ million drilling program in the Permian Basin and divested of $200+ million in assets across Wyoming and Utah. He holds a B.S. in Petroleum Engineering from the University of Oklahoma and a Series 65 securities license.

Maurice Dukes

Mr. Gornick has over 30 years of oil and gas experience, and has been directing operations, increasing production and proven reserves, and evaluating oil and gas reservoirs in North America since 1990. In addition to being President of East Peak Companies, he is the Chief Reservoir Engineer for Nissan Chemical. His current suite of projects includes new applications for EOR, completions, paraffin treatment, and CO2/helium production. Previously, Mr. Gornick was instrumental in expanding Whiting’s production from around 10,000 barrels per day to over 150,000 barrels per day over a 10 year period. While at QEP Resources, he was responsible for adding 35 million barrels of proved reserves. Steve holds a B.S. in Petroleum Engineering and an MS in Mineral Economics/Operations Research from the Colorado School of Mines.

Stephen Gornick

Mr. Tate is a nationally recognized securities, finance and fintech attorney and counsels’ clients throughout the U.S. and internationally on structured finance, private and public securities offerings, fintech, initial coin offerings and tokens sales, SEC reporting, real estate financings, venture capital and angel financings, fund formation and compliance, business formation and corporate governance. Marty also represents several entrepreneurs, small and large companies as well as private investors, finance companies, national and regional banks, investment banks and venture capital and private equity firms. In working with such clients, he regularly advises on various transactions, financings, contracts and agreements in an array of matters. Throughout his career, he has provided counsel in association with over $500 million in debt and equity financings.

Marty Tate

Mr. Sloan has over 30 years of oil and gas experience. He brings deep knowledge of upstream A&D processes, partnerships and corporate governance. Most recently as President and CEO he oversaw the completion of over a dozen US onshore divestments by Vanguard Natural Resources to mostly private operators and gained relevant insights into PetroFunders’ marketplace. Previously Mr. Sloan held senior leadership roles including SVP of Strategy for Hess and President of BP Russia; numerous corporate and business unit level CFO roles; and A&D oriented roles such as M&A Director for BP. Mr. Sloan has extensive experience in the board room as a director for companies including Vanguard Natural Resources, TNK and Medgaz . He graduated from Colgate University with BA in Economics (Honors) and from the University of Chicago with an MBA.

Scott Sloan

A Curated List of Actively Managed Investment Opportunities

Energy based investments are generally not accessible to the public. We don’t just manage your investment, we invest alongside you.

Early Bird

Early investors are rewarded with Early Bird incentives.

Available up to $5 Million

- Incentive 1

- Incentive 2

- Incentive 3

On Time

Early investors are rewarded with On-Time incentives.

Available up to $5-7 Million

- Incentive 1

- Incentive 2

- Incentive 3

Late Arrival

Early investors are rewarded with Early Bird incentives.

Available up to $7-10 Million

- Incentive 1

- Incentive 2

- Incentive 3

ESG Overview

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Gravida cum sociis natoque penatibus et magnis dis parturient. Ornare aenean euismod elementum nisi quis. Elementum nibh tellus molestie nunc non blandit massa enim nec. Dolor sit amet consectetur adipiscing. Scelerisque felis imperdiet proin fermentum leo vel orci porta. Viverra nibh cras pulvinar mattis nunc sed blandit. Ornare quam viverra orci sagittis eu volutpat. Praesent tristique magna sit amet.

PetroFunders’ sustainable development goals:

Sustainable Goal

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore.

Sustainable Goal

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore.

Sustainable Goal

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore.

We Do the Due Dilligence

Royalty Fund

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor

Royalty Fund

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor

Royalty Fund

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor

Early Bird

Early investors are rewarded with Early Bird incentives.

Available up to $5-7 Million

- Incentive 1

- Incentive 2

- Incentive 3

Early Bird

Early investors are rewarded with On-Time incentives.

Available up to $5 Million

- Incentive 1

- Incentive 2

- Incentive 3